At the beginning of this year I promised I would share a little bit about the budgeting system I use. I hope that this will be of help to you. I have made plenty of money related mistakes in the past and by 2008 I was in debt and my wage was not covering my expenses. This is when I have started budgeting and with a few breaks I have continued applying my method to this day. So if you are completely lost and maybe in debt, I know how you must feel.

At the beginning of this year I promised I would share a little bit about the budgeting system I use. I hope that this will be of help to you. I have made plenty of money related mistakes in the past and by 2008 I was in debt and my wage was not covering my expenses. This is when I have started budgeting and with a few breaks I have continued applying my method to this day. So if you are completely lost and maybe in debt, I know how you must feel.

So here are my five steps to basic budgeting.

STEP 1. Review your expenses and be honest with yourself! Because you need to have a clear view of your spending before setting an actual budget. See how much you spend for food, rent, transport not forgetting those sneaky annual subscriptions. Write a list of what you spend money on and how much in each category. Try to keep it monthly, so items that are annual should be divided by 12 to let you know how much you should budget towards them in any month..

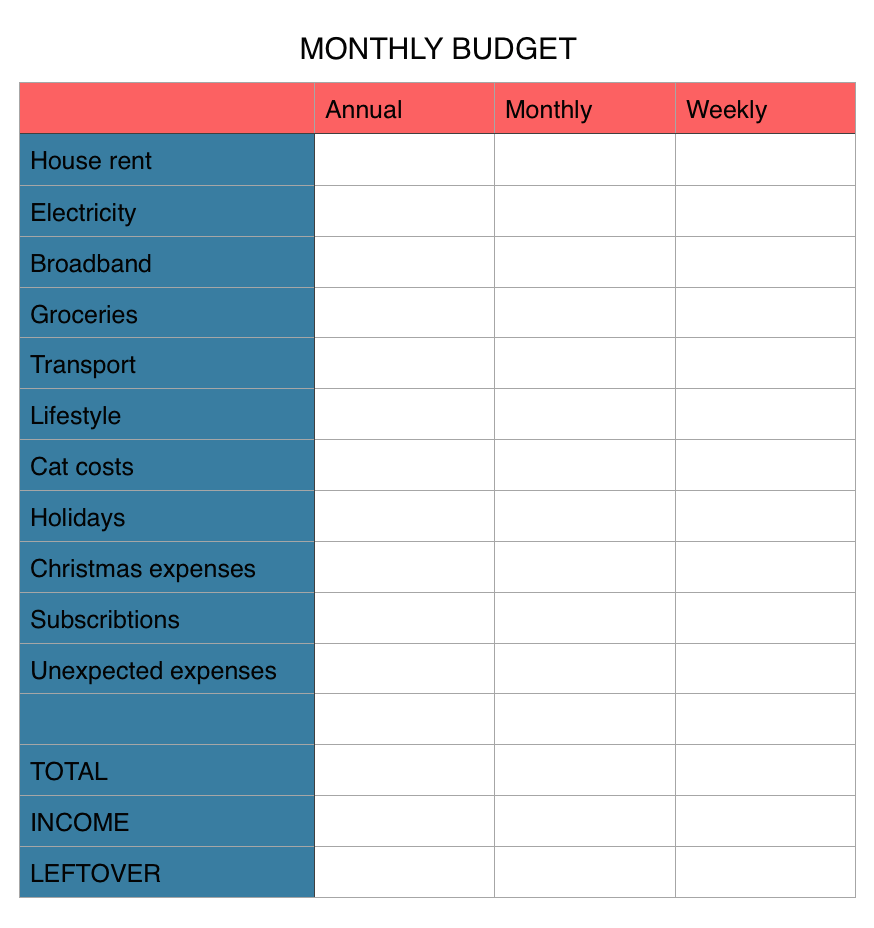

STEP 2. Set monthly allowances! Once you reviewed your expenses you can start deciding how much you should spend each month in each category. e.g. food, transport or some craft supplies. Don’t forget to set some money aside each month for unexpected expenses and even Christmas costs (I know it’s little early to think about Christmas but it really helps to have a lump some at the end of the year ready to spend on all those gifts, food, and hosting). When it comes to the lifestyle budget, I would say be reasonably generous (unless you are paying off some debts). Because you need to treat yourself often enough! I used to set a very small budget for my lifestyle and often used to overspend it leading to even quitting budgeting all together sometimes. So it’s better to keep your budget then trying to save unrealistic amount of money. Another thing I would suggest is to make a spreadsheet for your budget. It’s so much easer to your goals when it is placed in writing!  STEP 3: Put some money to savings. After you have worked out your budget you can now work out how much you have leftover. Some people say that you should first set money to save and then count your budget. But I think my way is easer, because I believe that it helps to save more when you earn more and then use some of the savings when you earn little. Your choice! I generally set up a standing order to go out each month for saving. Online banking is awesome!

STEP 3: Put some money to savings. After you have worked out your budget you can now work out how much you have leftover. Some people say that you should first set money to save and then count your budget. But I think my way is easer, because I believe that it helps to save more when you earn more and then use some of the savings when you earn little. Your choice! I generally set up a standing order to go out each month for saving. Online banking is awesome!

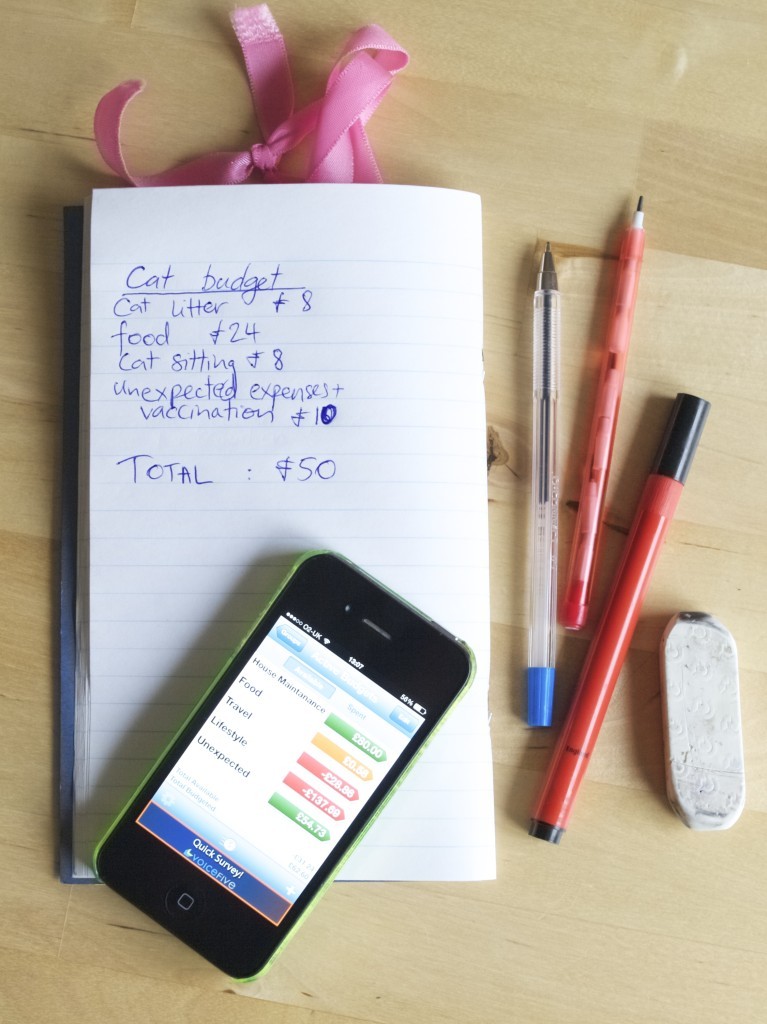

STEP 4: Track your expenses every time you shop. Back in 2008 I had a spreadsheet to record my spendings. I used to collect receipts and then at the end of the day I used to type it all up. Luckily in 2009 I have got myself a smartphone where I could track my budgeting on the spot (The app I used and still use is called “Spend”). As you can imagine my purse got slightly without that bulk of those receipts!

STEP 5: Review your budget once in the while (not only in January). You need to constantly check what you are spending and whether it is less then expected and maybe set a smaller budget. Or maybe there are expenses that you don’t have a budget for? Recently we realised we needed a new budget category as Leia our cat was constantly draining our grocery and lifestyle budgets. We would not have noticed that if we did not do our budget reviews!

Recently we realised we needed a new budget category as Leia our cat was constantly draining our grocery and lifestyle budgets. We would not have noticed that if we did not do our budget reviews! I hope you found this useful!

I hope you found this useful!

Rasa xoxo

No comments yet.